Securing long-term competitiveness in paper and board mills during disruptive times

During past two years Europe have witnessed a global pandemic and war starting inside its boarders. Two back-to-back crises have created a snowball effect to the European economy causing production costs also in the paper and board industry to soar. Impact of the cost inflation is not the same for everyone, but what should the producers do to be in the winning side?

Production cash costs of European paper and board producers

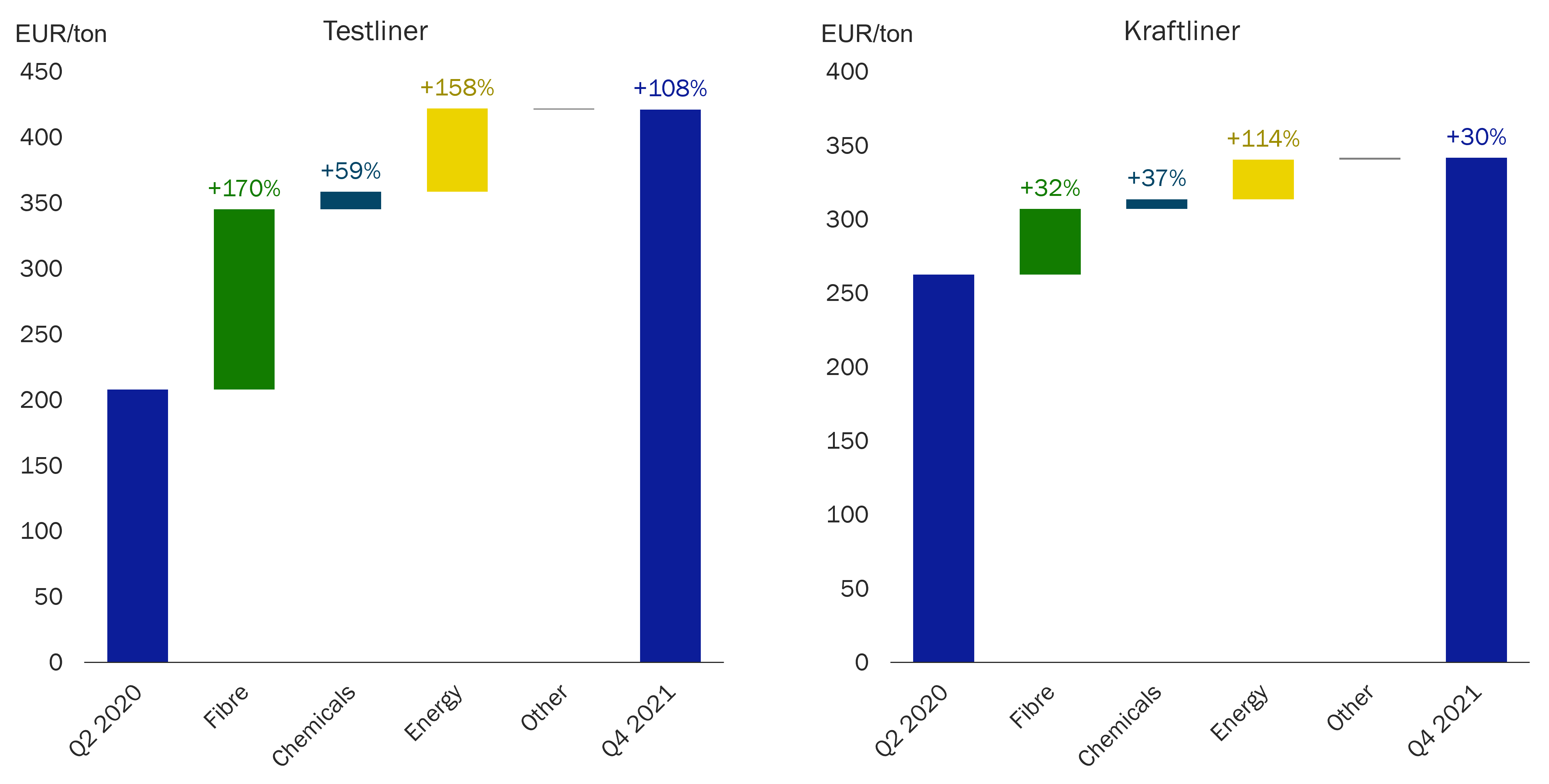

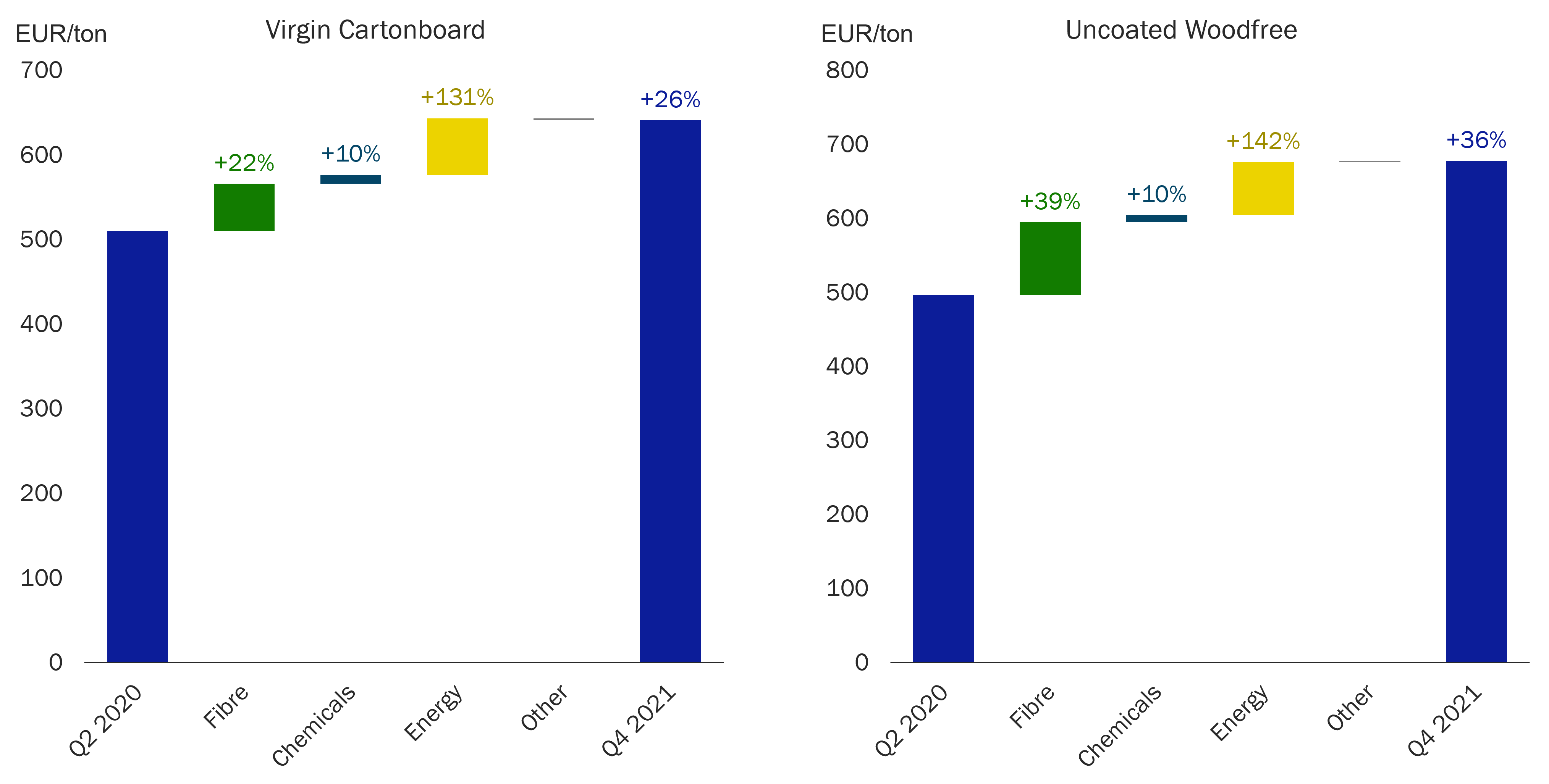

Production cash costs of European paper and board producers have significantly increased from the levels of early 2020.

As described in the figures, most cost fluctuation have been seen in energy and fibre costs, and to some extent also in chemicals cost. For testliner, kraftliner, virgin cartonboard and uncoated woodfree papers, the energy prices have more than doubled between early 2020 and late 2021. Impact has been highest for producers fully dependent on fossil fuels and purchased electricity. Increasing energy prices are creating additional upwards pressure also to many commodity prices, such as chemicals used in paper and board production. Fibre costs have increased especially for those dependent on market pulp or recycled fibre, but recently also for integrated producers as the competition over wood have tightened to extreme in several European countries. On top of all, increasing logistic costs are worsening the competitive situation of the most remote producers.

Average production cash cost of development of selected grades for European producers prior the war in Ukraine, from Q2 2020 to Q42021. (Source: RISI)

What action should be taken to mitigate the cost risks in long-term?

Economic uncertainty increases overall the risks related to cost competitiveness. The situation is different to each paper and board producer, but there are some general guidelines that help producers to navigate through these disruptive times and foster competitiveness in long-term.

1. Optimize and secure long-term wood and fibre sourcing

Understanding possible future scenarios and risks related to wood and fibre supply. Identifying specific demands for companies or operations and developing a sourcing strategy to secure long-term supply and to mitigate the scarcity risks

2. Focus on the energy efficiency of the production assets

Analysing energy assets from conceptual and operational viewpoint to understand the existing assets potential. Reviewing energy strategy and creating a tangible roadmap with improvement options for increased energy efficiency and reduced carbon footprint.

3. Improve the operational and raw-material efficiency of the production assets

Evaluating production asset capability to identify main bottlenecks and improvement potential. Maximizing the production output of assets with minimum CAPEX, while optimizing the cost structure of the production.

4. Invest in sustainable and fossil-free technologies

Sustainability considerations should be included in any investment decision. Decreasing the dependency on fossil fuels and overall carbon footprint of the assets helps to secure long-term competitiveness and feasibility of investments.

See related article: European economy under a snowball effect

Vision Hunters provides strategic advisory services for the forest and bio-based industries, and energy sectors. We assist leadership teams in making the smartest strategic choices to improve the outcome of their company in the future. We are highly experienced and result-oriented and have advised many of the leading companies in our industry.