The unmapped potential of German state and privately owned forests

There are 3.5 million hectares covered in this green gold in Bayern and Nordhein-Westfalen regions, of which nearly one million is state-owned.

The breathing green reserve

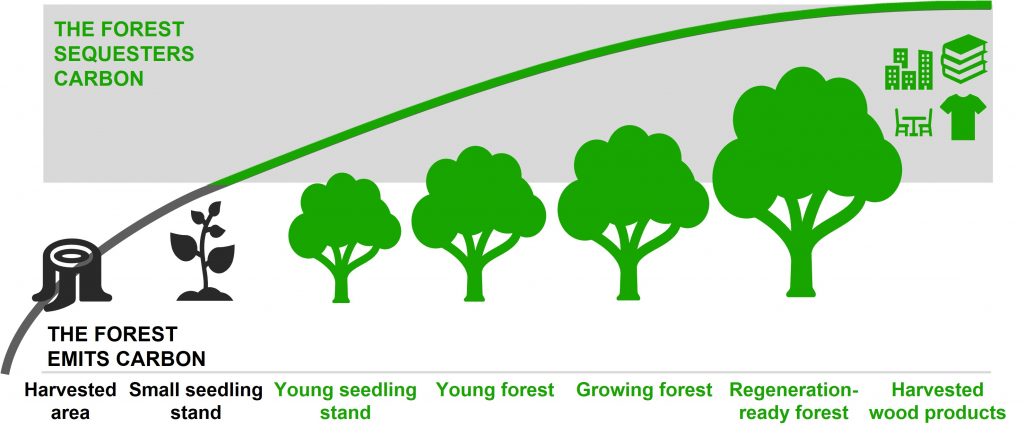

The value of the forests is manifold as they serve ecological, economic, and social needs. The role of the forests is highlighted in the climate change combat. Forests act as nature’s lungs sequestrating carbon especially in the growth stage. During recent years German forests have faced many damages, such as storms, forest fires and bark beetle infestations. According to the agricultural ministry, 2020 killed more surveyed trees than any recorder year before. The German government has already established 1.5 billion euro support scheme to encourage forest owners to reforestation and to deal with forest damages.

A Source for Solutions

Companies and countries increasingly recognize the value of the forests as the year 2022 is characterized by shocks and constant change. After starting to recover from the covid-19 pandemic a new crisis hits Europe. Raw material availability, energy prices and logistic disruptions shape the forestry market outlook with a heavy hand. The prices of wood-based raw materials have soared high, as the demand exceeds supply in all major markets while expansionary monetary policy is speeding up the inflation. States and companies must restructure to survive and build sustainable growth. Due to economic iron curtain descending between Europe and Russia the trade flows must be re-routed. The luring energy crisis also calls for immediate actions. Stakeholders are faced with a major dilemma: how to maintain biodiversity and reach for the goals related to sustainability and carbon neutrality while ensuring the raw material availability for different businesses?

Maximizing the Manifold Value of Forests

In times of distress the asset allocation shifts to more conservative investments. Forests can be seen as safe-haven investment especially in the environment of low interest rates. Investing in forest management is long-term activity since it takes up to 80 years for a tree to reach the harvesting age. With proper management the annual value increase in forest assets is steadier compared to other commodities or stocks. Hence, the role of good forest asset management is emphasized in market turbulences. Forest owners need to construct a roadmap to steer their assets towards manifold value maximization. Today, there are differentiating views and forest-related needs to be reconciled. We here at Vision Hunters are privileged to help our German clients to find and implement solutions to increase value in sustainable managed forests.

On the author: Hanna Lahtinen, Strategy Analyst. Hanna has a Master of Science in Economics & Business Administration and has also studies in Environmental Engineering. She has experience in circular economy from the primary and secondary sectors and is keen to promote sustainable use of natural resources

Vision Hunters provides strategic advisory services for the forest and bio-based industries, and energy sectors. We assist leadership teams in making the smartest strategic choices to improve the outcome of their company in the future. We are highly experienced and result-oriented and have advised many of the leading companies in our industry.

Related content: Forest and bio-based industries – a part of mitigating the global environmental chrisis

and How do EU guidelines impact the Forest Industry?