The cornerstone of the green transition is public-private funding cooperation

Through the Green Deal, the European Union has committed to becoming carbon neutral by 2050. To reduce greenhouse gas emissions by 55 percent by 2030 and reach carbon neutrality by 2050, the Green Deal package sets a roadmap with actions and a regulatory framework. Due to the global pandemic and the war in Ukraine, the Green Deal’s progress has stagnated, but at the time of writing, progress is being made and words are turning into action.

Funding accelerates the shift to a circular economy

Due to the pricing, targeting, and regulating activities of greenhouse emissions, the EU Fit for 55 legislative package’s new and updated rules and control mechanism will refocus investments on low carbon technology solutions. However, this alone is insufficient; significant long-term funding must be mobilised across the financial spectrum. Cooperation between public and private funding is crucial for securing the financial requirements of more sustainable technologies and aligning with the green transition targets.

Through a variety of program packages, public funding is becoming increasingly available for the development and deployment of low-carbon technologies. The aim of public funding is to accelerate the market implementation of new innovative low-carbon technological solutions by funding research, new low-carbon demonstration, and innovative plants that seek answers to pressing global challenges while also creating new business opportunities.

The public funding pie

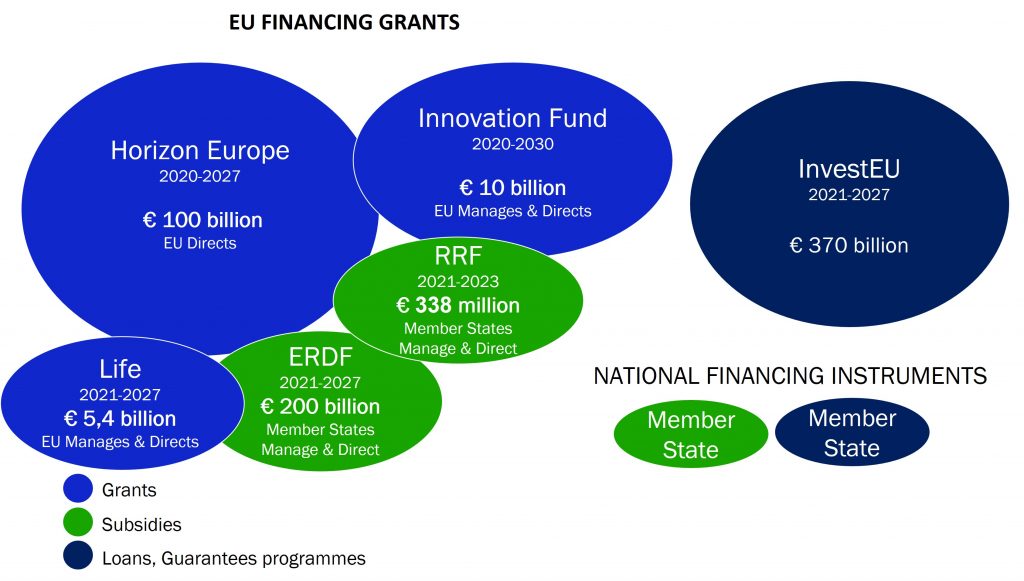

The EU and member states provide funding to encourage low-carbon initiatives through a variety of projects and programmes that are tightly controlled to ensure that green funding is spent transparently and accountable. The public funding can be divided into following segments:

- Grants

- Subsidies

- Loans, guarantees etc.

- Awards

Grants are typically controlled by the EU and are linked to specific projects relevant to EU policies, to which applicants apply by responding to calls for proposals for specific public programmes. Subsidies are managed by national and regional governments in partnership with the EU, for which a separate application is required. In addition to the EU financing instrument, each member state has its own specific funding programmes for climate initiatives, with a focus, annual budget, and time frame that is unique to that nation.

Figure 1: The most relevant EU financing instruments for the green transition and their overall budgets.

Figure 1: The most relevant EU financing instruments for the green transition and their overall budgets.

Setting the rules of the game

Public funding alone is not enough to finance future new circular economy and new low carbon technological solutions. Private investment capital must also be channeled toward sustainable investments. As a result, it is critical to establish clear criteria for what constitutes as a sustainable and environmentally friendly investment. To achieve a clear shared understanding of what sustainable means, the EU has developed a classification system known as taxonomy, which can be considered the most important tool of this sustainable finance action plan.

Taxonomy will define what activities are considered sustainable in the future, and it will gradually be integrated into EU legislation to steer production and channel capital towards sustainable solutions. However, due to the complexity and highly technical nature of developing a classification system, it will take time before a fully-fledged EU sustainability taxonomy spanning climate, environment, and social issues is integrated into EU legislation.

The taxonomy classification system will be implemented in a step-by-step manner, beginning with climate change mitigation and adaptation activities, and progressing to the remaining environmental and social activities.

In addition to taxonomy, the EU is implementing regulatory criteria to channel capital flow into more sustainable solutions, as well as to tackle lack of legibility, greenwashing, and create greater transparency surrounding Environmental, Social, and Governance (ESG) actions and policies. These are carried out in accordance with the Sustainable Finance Disclosure Regulation (SFDR) and the Non-Financial Reporting Directive (NFRD). SFDR-regulation mandates financial institutions and their investment advisers to disclose how they consider sustainability risks in their investment decisions. Whereas the aim of the NFRD Reporting Directive is to ensure that sufficient information on corporate responsibility and sustainability impacts is available in the future.

Ongoing heated discussion on wood

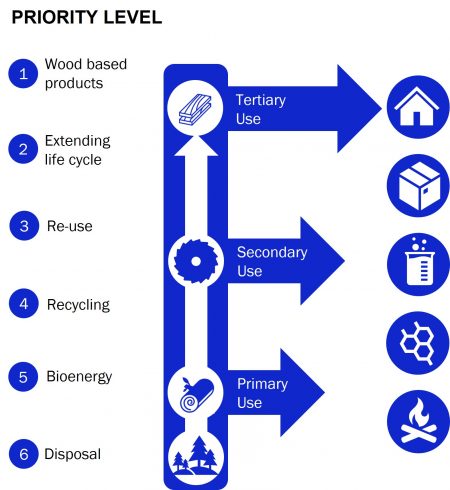

The use of wood in the REDIII Directive is currently the topic of heated discussion in the EU and among Member States. The Parliament took a more stringent position on the use of primary wood for energy generation than the Commission’s suggestion. The Parliament desires to steer the utilisation of primary wood toward more high-value-added products in accordance with the cascade principle, with the goal of developing new, high-value-added bio-based solutions and a sustainable circular bioeconomy.

According to the proposal, primary wood would be considered as a renewable if the share of primary wood in total energy consumption remains at the same level as the 2017-2022 average by country. The REDIII decisions are expected to be reflected in the taxonomic classifications system, which will be expanded and updated later.

Figure 2. The Parliament desires to steer the utilisation of primary wood toward more high-value-added products in accordance with the cascade principle, with the goal of developing new, high-value-added bio-based solutions and a sustainable circular bioeconomy.

Figure 2. The Parliament desires to steer the utilisation of primary wood toward more high-value-added products in accordance with the cascade principle, with the goal of developing new, high-value-added bio-based solutions and a sustainable circular bioeconomy.

Sustainable actions drive the business

Taxonomy, NFDR- and SDR-regulations enable the standardisation of green loans and guarantees, making it easier for investors to assess the sustainability and accountability of investments. Many individual financial actors have also made their own commitments to sustainable development. Bank and investor commitments to carbon-neutral investment and loan portfolios have become increasingly common. The Global Sustainable Investment Alliance (GSIA) estimates that in early 2020, sustainable investments represented 36% of all professionally managed assets globally. The new sustainable financing rules will further improve the transparency of investments and the quality and scope of ESG reporting.

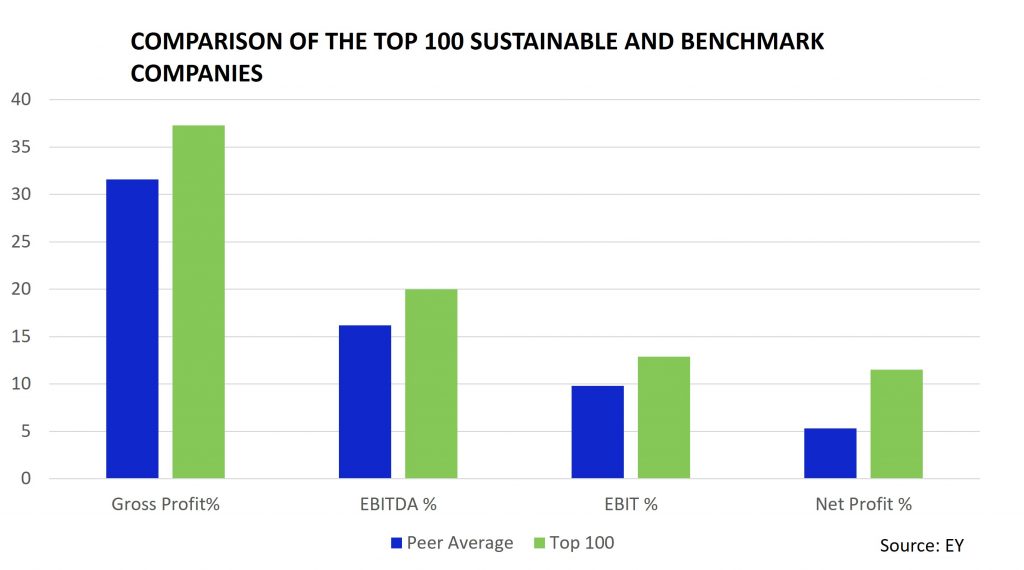

Sustainability measures will become increasingly important in business, for example, influencing the financing and pricing levels that banks offer, as well as other alternative services such as insurance, terms and conditions. As sustainability criteria grow more common, a company seeking financing will be required to provide a ‘sustainable transition plan’ alongside its business plan and traditional financial information. The growing relevance of sustainability creates pressure on companies to promote sustainable development while also generating profits for shareholders. The profitability of the top sustainable corporations in Corporate Knights’ 2020 Global 100 ranking was compared to the industry median corporations in an EY study. In this study, sustainable companies outperformed their industry peers in terms of gross profit, EBITDA, EBIT, and net profit. According to the study, companies who successfully integrate ESG considerations into their core business will be well-positioned to capitalise on these opportunities and generate new revenue streams for their business.

Towards the future

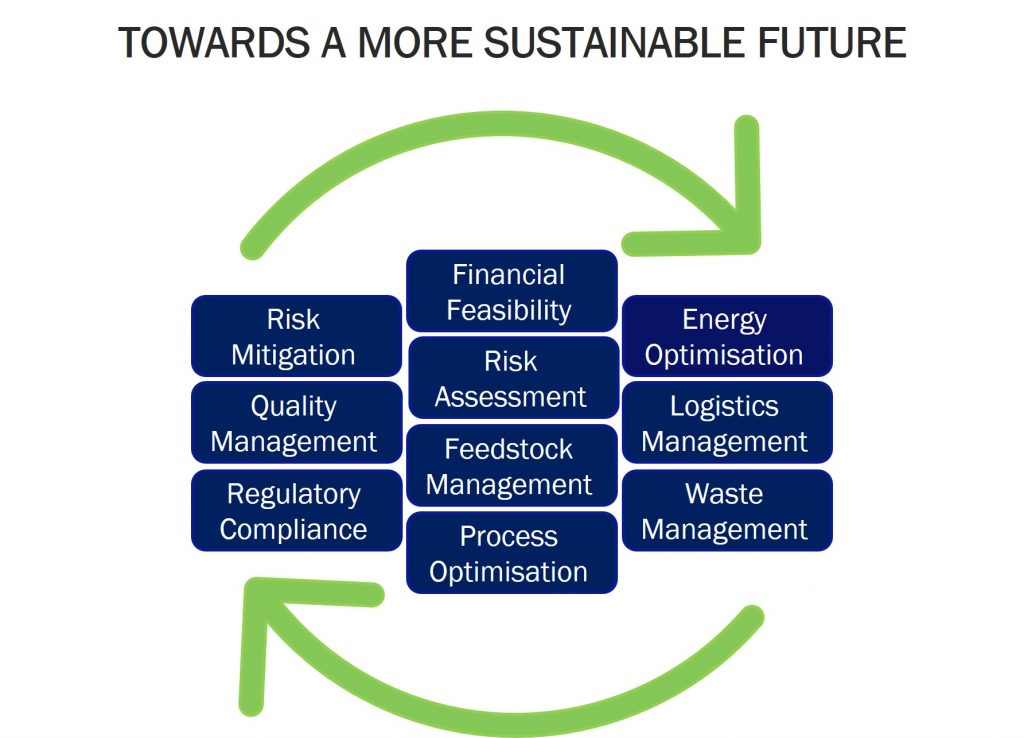

The transition to a circular economy presents significant challenges, but it also opens up new opportunities for future growth and expansion of products and services. The most effective and quickest strategy to affect future competitiveness is to take a proactive approach to sustainability. Future actions will have an impact on the entire value chain, gradually transforming society towards a more sustainable world.

Taking a proactive approach to sustainability

Steering production toward a more sustainable future requires a deeper understanding of where your business currently is, as well as the creation of a vision for the future. You need to identify areas of the business that are underutilised, challenge assumptions, identify risky blind spots, and truly optimise your performance by fully leveraging all primary and side streams.

As consultants, we firmly believe that in order for businesses to cope and prosper in a changing environment, they must further develop and integrate their business sectors, have a better understanding of the big picture, and strengthen collaboration across value chains.

On the author: Jussi Räsänen, Consultant. Jussi holds a MSc in Chemical Engineering and has a background as senior process engineer. He has a strong interest in bio-based materials and new energy solutions.

Vision Hunters provides strategic advisory services for the forest and bio-based industries, and energy sectors. We assist leadership teams in making the smartest strategic choices to improve the outcome of their company in the future. We are highly experienced and result-oriented and have advised many of the leading companies in our industry.